What Does Custom Private Equity Asset Managers Mean?

Wiki Article

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

(PE): spending in firms that are not openly traded. Roughly $11 (https://www.pageorama.com/?p=cpequityamtx). There may be a few things you don't recognize concerning the sector.

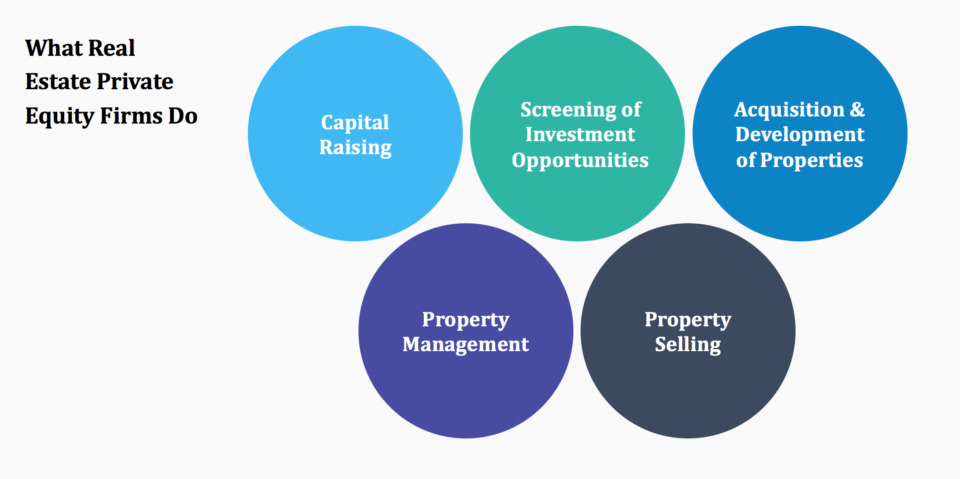

Companions at PE companies raise funds and manage the cash to yield positive returns for investors, commonly with an investment horizon of between four and 7 years. Private equity companies have a series of financial investment choices. Some are stringent financiers or passive financiers completely depending on management to grow the business and produce returns.

Since the finest gravitate towards the larger deals, the middle market is a substantially underserved market. There are a lot more vendors than there are extremely experienced and well-positioned money specialists with considerable buyer networks and sources to take care of a bargain. The returns of exclusive equity are typically seen after a couple of years.

Fascination About Custom Private Equity Asset Managers

Flying below the radar of big international companies, much of these little companies frequently provide higher-quality customer care and/or specific niche products and services that are not being supplied by the big conglomerates (https://www.openlearning.com/u/madgestiger-s56is4/about/). Such upsides draw in the interest of exclusive equity companies, as they have the understandings and smart to exploit such opportunities and take the firm to the next level

A lot of managers at portfolio firms are given equity and bonus settlement structures that award them for hitting their economic targets. Personal equity possibilities are commonly out of reach for individuals who can not invest millions of dollars, however they should not be.

There are guidelines, such as restrictions on the accumulation quantity of money and on the number of non-accredited investors. The private equity company draws in several of the most effective and brightest in corporate America, consisting of top entertainers from Ton of money 500 firms and elite management consulting firms. Law office can likewise be recruiting grounds for private equity employs, as audit and lawful skills are needed to full bargains, and deals are here are the findings very demanded. https://www.slideshare.net/madgestiger79601.

The Definitive Guide to Custom Private Equity Asset Managers

One more downside is the lack of liquidity; as soon as in a personal equity purchase, it is hard to leave or offer. There is a lack of flexibility. Exclusive equity likewise comes with high costs. With funds under management already in the trillions, exclusive equity companies have become appealing financial investment vehicles for well-off individuals and establishments.

For decades, the attributes of personal equity have made the possession course an appealing proposal for those who can participate. Currently that access to exclusive equity is opening up to even more individual financiers, the untapped possibility is becoming a truth. So the inquiry to consider is: why should you spend? We'll start with the main arguments for investing in exclusive equity: Exactly how and why private equity returns have historically been greater than various other assets on a number of levels, Exactly how consisting of exclusive equity in a portfolio impacts the risk-return profile, by assisting to diversify against market and cyclical danger, After that, we will certainly outline some key factors to consider and risks for private equity investors.

When it concerns introducing a brand-new property right into a profile, one of the most basic consideration is the risk-return account of that property. Historically, personal equity has actually shown returns similar to that of Emerging Market Equities and greater than all various other typical possession classes. Its fairly reduced volatility combined with its high returns produces a compelling risk-return account.

The Only Guide to Custom Private Equity Asset Managers

Actually, private equity fund quartiles have the best series of returns across all different asset classes - as you can see below. Methodology: Internal price of return (IRR) spreads calculated for funds within vintage years independently and after that averaged out. Mean IRR was calculated bytaking the standard of the typical IRR for funds within each vintage year.

The takeaway is that fund choice is critical. At Moonfare, we execute a rigid selection and due persistance procedure for all funds detailed on the platform. The result of including exclusive equity into a profile is - as constantly - dependent on the profile itself. A Pantheon research study from 2015 recommended that including private equity in a profile of pure public equity can unlock 3.

On the other hand, the most effective personal equity companies have access to an even bigger swimming pool of unknown chances that do not deal with the same examination, along with the sources to carry out due persistance on them and recognize which deserve buying (Private Equity Firm in Texas). Investing at the very beginning implies greater risk, but also for the business that do be successful, the fund benefits from higher returns

8 Simple Techniques For Custom Private Equity Asset Managers

Both public and exclusive equity fund managers commit to investing a percentage of the fund however there stays a well-trodden concern with straightening interests for public equity fund administration: the 'principal-agent trouble'. When a capitalist (the 'major') employs a public fund manager to take control of their resources (as an 'representative') they delegate control to the manager while keeping ownership of the possessions.

In the instance of exclusive equity, the General Companion does not simply make an administration cost. They likewise make a percentage of the fund's profits in the type of "carry" (usually 20%). This ensures that the interests of the manager are straightened with those of the capitalists. Private equity funds also mitigate an additional type of principal-agent trouble.

A public equity financier ultimately desires one point - for the monitoring to boost the stock price and/or pay out rewards. The financier has little to no control over the choice. We showed over the number of exclusive equity strategies - particularly majority acquistions - take control of the running of the firm, guaranteeing that the lasting value of the business precedes, pressing up the roi over the life of the fund.

Report this wiki page